Table of Contents

ToggleAre You Leaving Thousands in Nursing Loan Relief on the Table?

Picture this: you just passed your NCLEX, landed your first nursing position, and opened your student loan statement — only to feel the floor drop out from under you. If you are among the more than 85% of nursing graduates who borrowed to fund their education, you are not alone, and more importantly, substantial help already exists that most nurses never claim. The federal nursing student loan program was specifically designed for healthcare professionals like you — yet countless eligible nurses miss out simply because no one clearly explained where to start or what they genuinely qualify for.

This guide dismantles that confusion and walks you through 7 proven, comprehensive strategies to powerfully take control of your nursing education debt so you can focus on what you trained to do: save lives.

In the sections below, you will find current interest rate comparisons, side-by-side forgiveness program tables, repayment plan breakdowns, and actionable steps built from the very latest federal policy updates available in 2025. Whether you carry $12,000 or $120,000 in nursing education debt, at least one — and likely several — of these strategies applies directly to your situation.

- What qualifies as a federal nursing student loanand who is eligible to receive one

- Current interest rates, loan limits, and repayment timelinescompared side by side

- The 7 strategic stepsto reduce or completely eliminate your debt burden

- Loan forgiveness programsspecifically designed for working nurses

- Common costly mistakesnurses make — and how to avoid every one of them

#2

What Is a Federal Nursing Student Loan? Key Definitions Every Nurse Must Know

Understanding the landscape of government-backed nursing loans is the essential first step before any repayment or forgiveness strategy can be applied effectively. A federal nursing student loan is a low-interest, need-based loan administered through the U.S. Department of Health and Human Services (HHS) under the Nursing Student Loan (NSL) program — separate from, but often stacked alongside, standard federal student aid. Knowing the distinction between these loan types directly determines which repayment plans, deferment options, and forgiveness pathways are available to you.

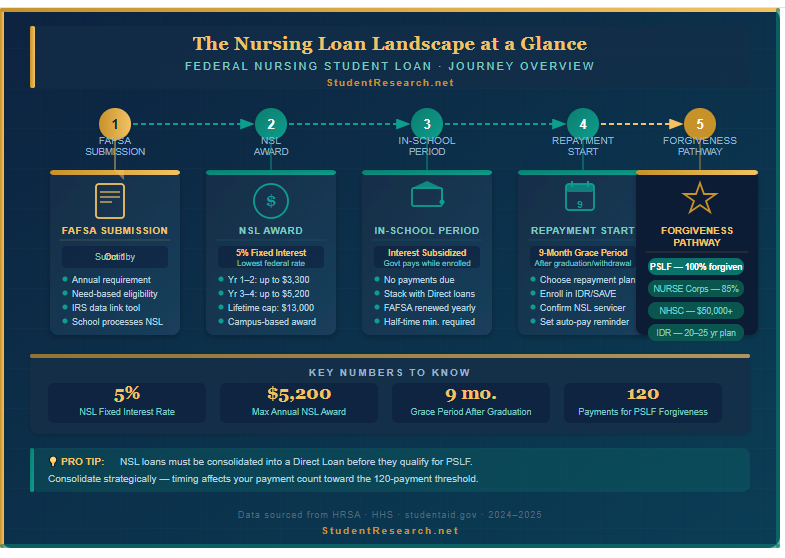

2.1 Nursing Student Loan (NSL) Program — Core Features

- Established underTitle VIII of the Public Health Service Act— health-profession specific

- Funded through institutional grants from HHS to accredited nursing schools — not directly to students

- Available to full-time and half-time students in accredited diploma, associate, BSN, and graduate nursing programs

- Fixed interest rate of5% per annum— below most private and Direct Loan alternatives

- Maximum annual award:$3,300for the first two years;$5,200for remaining years

- Repayment begins9 monthsafter graduation, withdrawal, or dropping below half-time enrollment

2.2 How NSL Differs from Standard Federal Student Loans

- NSL iscampus-based— your school, not a federal servicer, manages disbursement and initial repayment

- Eligibility requires demonstrated financial need verified annually through FAFSA

- Not originated through the Direct Loan Program — requires separate tracking in your loan portfolio

- May be serviced by a different entity than your other federal student loans

- Earlystudent researchinto the NSL program shows many borrowers conflate it with Perkins Loans — both are campus-based, but NSL is health-profession specific

Struggling to write that nursing paper? At StudentResearch.net, our expert academic writers deliver 100% plagiarism-free, original nursing essays — crafted to your exact requirements. Submit confidently. Your grades deserve nothing less.

TABLE 1 — Federal Nursing Student Loan vs. Other Federal Loan Types (2024–2025 Data)

| Feature | NSL (Nursing Student Loan) | Direct Subsidized | Direct Unsubsidized | Grad PLUS |

|---|---|---|---|---|

| Interest Rate | 5.0% (fixed) | 6.53% | 6.53% | 9.08% |

| Who Qualifies | Nursing students — need-based | Undergrad — need-based | All enrolled students | Grad/professional students |

| Annual Limit | $3,300–$5,200 | $3,500–$5,500 | $5,500–$20,500 | Cost of attendance |

| Interest Subsidy | Yes, while in-school | Yes, while in-school | No | No |

| Grace Period | 9 months | 6 months | 6 months | 6 months |

| Administered By | Nursing school bursar | Federal servicer | Federal servicer | Federal servicer |

| PSLF Eligible (direct) | No — must consolidate | Yes | Yes | Yes |

#3

Eligibility Requirements for a Federal Nursing Student Loan

Meeting the eligibility criteria for a federal nursing student loan is non-negotiable — and the requirements are considerably more nuanced than many applicants expect going in. Schools receive limited NSL funds annually and prioritize students who meet strict academic and financial benchmarks, making early and accurate preparation essential. Understanding every eligibility criterion before you apply significantly increases your chances of securing this valuable, low-cost funding over a competitor who applied late or incompletely.

3.1 Academic Eligibility Criteria

- Enrolledat least half-timein an accredited diploma, associate, baccalaureate, or graduate nursing program

- Maintainingsatisfactory academic progress(SAP) as defined by your institution

- U.S. citizen, national, or eligible non-citizen with valid Social Security Number

- Not in default on any existing federal education loan or grant overpayment

- Must sign a legally bindingpromissory noteagreeing to repayment terms before funds disburse

3.2 Financial Need Requirements

- Must complete and submit theFAFSA annually— no exceptions for continuing students

- Student Aid Index (SAI) assessed by your institution determines award amount

- Priority typically given to students with thegreatest demonstrated financial need

- Institutions may apply supplemental financial eligibility criteria beyond federal minimums

3.3 Program-Specific School Requirements

- Only students enrolled atparticipating HHS-funded institutionsqualify — not all schools receive NSL funds

- There is no centralized federal application portal for NSL — your school’sfinancial aid office manages all applications

- Application deadlines vary by institution — typicallyFebruary through Aprilfor the following academic year

- Verify your school’s participation status directly with the financial aid or bursar’s office before planning your budget around NSL funds

#4

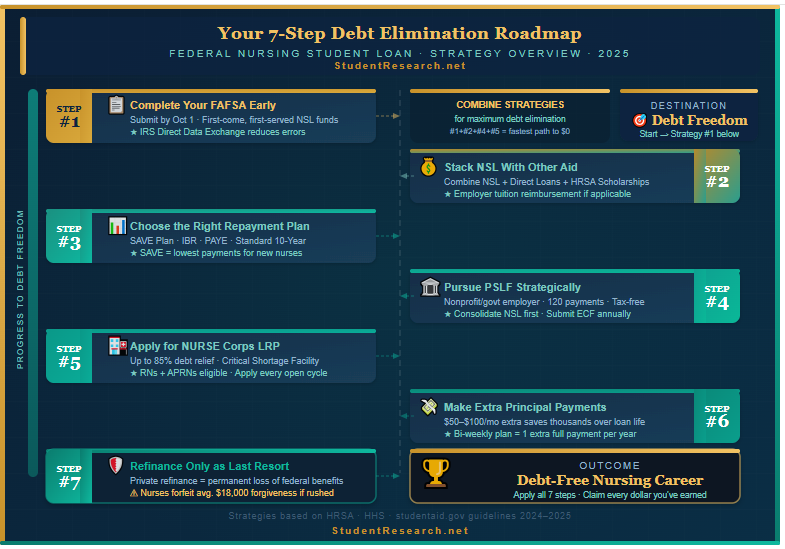

7 Proven Strategies to Powerfully Manage Your Federal Nursing Student Loan

Now that you understand the federal nursing student loan landscape clearly, it is time to take decisive action with the 7 most effective debt management strategies available to nurses in 2025. Each strategy builds on the next, creating a comprehensive roadmap that works whether you owe $10,000 or $100,000 in nursing education debt. The nurses who successfully eliminate their debt fastest are consistently those who combine multiple strategies simultaneously rather than relying on a single approach.

Strategy #1

Complete Your FAFSA Early and Accurately Every Year

- Submit your FAFSA as close toOctober 1as possible — NSL funds are awarded on a first-come, first-served basis

- Errors on the FAFSA delay processing and cost you priority access to limited campus-based funds

- Use theIRS Direct Data Exchangetool to auto-populate tax data and minimize errors

- Follow up with your school’s financial aid office within 2–3 weeks of FAFSA submission to confirm receipt

- Early filers receive significantly higher institutional aid awards — confirmed across multiple years ofstudent researchinto FAFSA completion patterns

Strategy #2

Stack NSL with Other Federal and Institutional Aid Sources

- Combine yournursing student loan fundingwith Direct Subsidized loans for maximum in-school interest savings

- Apply for theHRSA NURSE Corps Scholarship— funds that never require repayment

- Investigate your state nursing scholarship programs that run in parallel to federal aid cycles

- If pursuing an advanced degree while working, explore yourhospital employer’s tuition reimbursementprogram

Strategy #3

Choose the Right Repayment Plan from Day One

- Standard 10-Year Planminimizes total interest paid — best if your income can comfortably cover payments

- SAVE Plan(the newest IDR option) caps undergraduate loan payments at 5% of discretionary income — lowest available

- PAYE and IBRplans cap payments at 10% of discretionary income — ideal for mid-range debt loads

- Graduated Repayment starts low and increases — suited for nurses whose income is expected to grow quickly

- Extended Repayment (25 years) should be considered a last resort due to the substantially higher total interest cost

Strategy #4

Pursue Public Service Loan Forgiveness (PSLF) Strategically

- Work full-time for a qualifying501(c)(3) nonprofit hospital, public health agency, or government employer

- Make120 qualifying monthly paymentsunder an IDR plan — 10 years of service

- Submit the PSLF Employment Certification Form (ECF)annually— do not wait until your 120th payment

- Critical:NSL loans must be consolidated into a Direct Consolidation Loan before counting toward PSLF

- All PSLF forgiveness is currently100% tax-freeunder federal law

Strategy #5

Apply for the NURSE Corps Loan Repayment Program

- Provides up to85% repaymentof qualifying nursing education debt over a 2–3 year commitment

- Requires service at a federally designatedCritical Shortage Facility (CSF)

- Applications open annually — typically in spring; competition is intense so apply every eligible year

- Both RNs and Advanced Practice Registered Nurses (APRNs) are eligible to apply

- Can belayered with NSL and PSLF strategiesfor maximum combined debt relief impact

Strategy #6

Make Extra Principal Payments Strategically and Consistently

- Even$50–$100 extra per monthapplied to principal can save thousands over a loan’s full life

- Always specify in writing that extra payments go towardprincipal — not future payments

- Use windfalls — tax refunds, overtime bonuses, shift differentials — as lump-sum principal payments

- Bi-weekly payment schedules effectively generateone additional full payment per yearwith no lifestyle sacrifice

Strategy #7

Refinance Private Debt Only — Protect Your Federal Nursing Loan Benefits

- Refinancingfederal nursing loansinto private loanspermanently strips all federal protections

- You immediately lose access to IDR plans, PSLF eligibility, deferment, and forbearance options

- If you work for a nonprofit employer or are pursuing PSLF,never refinance federal loans into private ones

- Refinancing is only appropriate if: you are in the private sector, have a stable high income, and have exhausted all forgiveness pathways

- Extensivestudent researchinto refinancing decisions shows nurses who refinance prematurely forfeit an average of$18,000 in potential forgiveness

#5

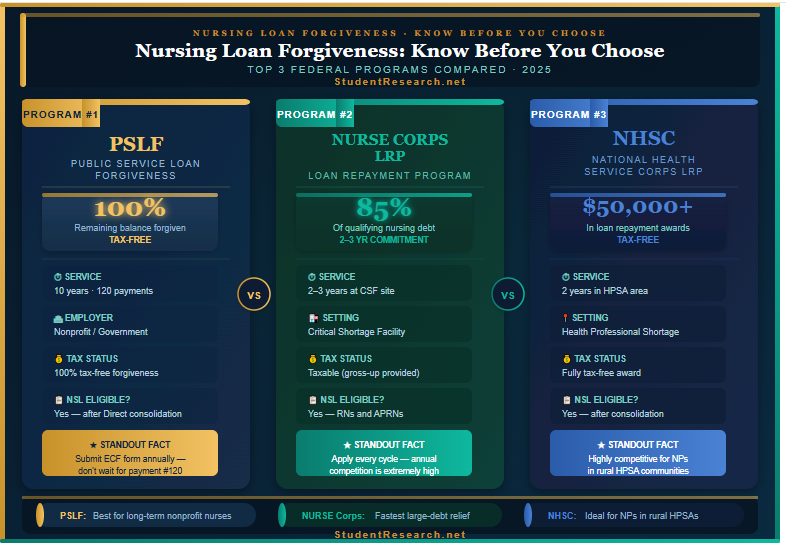

Federal Nursing Student Loan Forgiveness Programs: A Complete Comparison

Loan forgiveness is the single most powerful tool available to nurses carrying significant education debt — yet it remains one of the most misunderstood and underutilized benefits in the entire profession. Multiple federal and state-level nursing loan forgiveness programs exist simultaneously, and many nurses qualify for more than one at the same time. Conducting thorough student research before selecting a forgiveness strategy is the difference between leaving tens of thousands of dollars permanently on the table and walking away completely debt-free.

TABLE 2 — T-Column Comparison: Top Federal Nursing Loan Forgiveness Programs (2025)

| Program | Max Forgiveness | Service Requirement | Tax Treatment | NSL Eligible? |

|---|---|---|---|---|

| PSLF | 100% remaining balance | 10 yrs / 120 payments — nonprofit/govt employer | Tax-free | Yes — after Direct consolidation |

| NURSE Corps LRP | Up to 85% of total debt | 2–3 years at a Critical Shortage Facility | Taxable (gross-up provided) | Yes |

| NHSC Loan Repayment | $50,000+ | 2 years in HPSA-designated area | Tax-free | Yes — after consolidation |

| IHS Loan Repayment | Up to $40,000 | 2 years serving tribal communities | Tax-free | Yes |

| IDR Forgiveness (SAVE) | Remaining balance after 20–25 yrs | Consistent IDR payments over repayment term | Tax-free through 2025 (law-dependent) | Yes — after consolidation |

| State Programs (avg.) | $5,000–$30,000+ | 1–4 years in underserved/rural areas | Varies by state | Varies by state program |

5.1 Step-by-Step Path to PSLF as a Nurse

- Step I —Confirm your employer qualifies using the PSLF Help Tool at studentaid.gov before accepting the role

- Step II —Enroll in a qualifying IDR plan — SAVE, PAYE, IBR, or ICR are all eligible

- Step III —Consolidate any NSL or Perkins loans into a Direct Consolidation Loan strategically

- Step IV —Submit the Employment Certification Form (ECF) annually and whenever you change employers

- Step V —After 120 qualifying payments, submit the official PSLF Application for Forgiveness

5.1a — Critical PSLF Errors That Cost Nurses Their Forgiveness

- Enrolling in the Standard 10-Year plan instead of a qualifying IDR plan

- Working for a for-profit staffing agency placed inside a nonprofit hospital — the employer entity matters, not the facility

- Failing to submit the ECF annually — this creates dangerous verification gaps at year 10

- Not consolidating NSL loans before counting payments toward the required 120

#6

Repayment Plans for Federal Nursing Student Loans: Which Plan Is Right for You?

Choosing the wrong repayment plan is one of the most costly mistakes a nursing graduate can make — yet it is also one of the easiest mistakes to avoid with the right, timely information. Federal income-driven repayment options expanded significantly in 2023 and 2024, providing nurses across all income levels with genuinely affordable monthly payment options for the first time. Understanding the mechanics of each plan — and how they interact specifically with your federal nursing student loan portfolio — is the foundation of every smart debt exit strategy.

TABLE 3 — IDR Repayment Plan Comparison for Nurses (2024–2025)

| IDR Plan | Payment Cap | Forgiveness At | Best For |

|---|---|---|---|

| SAVE (New 2023) | 5% discretionary (undergrad); 10% (grad) | 10 yrs (small balance) / 20–25 yrs | New graduates with lower starting salaries |

| PAYE | 10% of discretionary income | 20 years | High debt-to-income ratio nurses |

| IBR (post-July 2014) | 10% of discretionary income | 20 years | Nurses who borrowed after July 2014 |

| IBR (pre-July 2014) | 15% of discretionary income | 25 years | Nurses who borrowed before July 2014 |

| ICR | 20% discretionary or 12-yr fixed (lesser) | 25 years | Parent PLUS borrowers consolidating |

6.1 Deferment and Forbearance Options for Nurses

- In-school deferment:no payments required while enrolled at least half-time in a qualifying program

- Economic hardship deferment:available if income falls below 150% of the federal poverty guideline

- Unemployment deferment:up to 3 years if actively seeking employment

- Mandatory forbearance:available during NURSE Corps service, medical residency, and qualifying AmeriCorps service

- General forbearance:discretionary — interest continues to accrue; use sparingly

#7

Advanced Practice Nurses and Graduate Nursing Loans: What Changes at the Graduate Level?

Advanced Practice Registered Nurses (APRNs) — including nurse practitioners, certified registered nurse anesthetists, clinical nurse specialists, and certified nurse midwives — carry substantially higher education debt loads than entry-level RNs due to the additional years of graduate study their credentials require. The federal nursing student loan landscape for graduate-level borrowers includes higher borrowing limits, expanded forgiveness pathways, and unique employer-sponsored repayment options unavailable to undergraduate nursing students. Knowing the graduate-specific dimensions of nursing debt management puts APRNs in a dramatically stronger financial position from the first day of practice.

7.1 Graduate Nursing Loan Limits and Interest Rates (2024–2025)

- Direct Unsubsidized Loans for graduate nursing students: up to$20,500 annually

- Grad PLUS Loans: up to full cost of attendance minus all other aid received

- Grad PLUS interest rate:9.08%— making strategicnursing loanplanning even more financially critical

- NSL for graduate nursing students: up to$5,200/year at 5%— the single lowest available federal rate

- NSL lifetime program cap:$13,000across the full nursing program enrollment

7.2 APRN-Specific Loan Forgiveness Opportunities

- NHSC Loan Repayment Program:highly competitive for nurse practitioners in Health Professional Shortage Areas (HPSAs)

- State NP incentive programs:many states offer $20,000–$30,000 to NPs committing to rural or underserved settings

- Indian Health Service (IHS) Loan Repayment:up to $40,000 for a 2-year commitment serving American Indian/Alaska Native communities

- VA VALOR Program:loan assistance for APRNs who commit to Veterans Affairs healthcare service

#8

Common Federal Nursing Student Loan Mistakes and How to Avoid Every One

Even the most diligent nursing graduates make costly federal nursing loan errors — not from carelessness, but from a simple lack of clearly communicated and accessible information. The following mistakes are the most frequently documented through ongoing student research and federal borrower advocacy reports, and each has a clear, actionable solution that costs nothing to implement. Recognizing these pitfalls before they affect your financial trajectory is far less painful than correcting them after years of misdirected payments.

Mistake #1 — Not Tracking Your NSL Separately from Other Federal Loans

- NSL loans are campus-based and may be serviced by a completely different entity than your Direct Loans

- Solution:Contact your school’s bursar and financial aid office immediately after graduation to confirm your NSL balance and assigned servicer

Mistake #2 — Missing the 9-Month Repayment Start Date

- NSL repayment begins 9 months post-graduation — missing the first payment triggers delinquency that damages credit quickly

- Solution:Set a calendar reminder 8 months after graduation to confirm your first payment amount and exact due date

Mistake #3 — Refinancing Before Exhausting All Forgiveness Pathways

- Refinancing afederal nursing student loaninto private debt permanently eliminates all federal protections and forgiveness eligibility

- Solution:Exhaust every federal forgiveness pathway — PSLF, NURSE Corps, NHSC — before considering any private refinancing

Mistake #4 — Missing Annual IDR Recertification Deadlines

- Failing to recertify income annually causes your IDR payment to reset automatically to the Standard Plan amount — often 2–4 times higher

- Solution:Set annual calendar reminders and recertify income proactively — never wait passively for servicer notices

Mistake #5 — Working for a For-Profit Entity Unknowingly

- Some hospital systems operate for-profit subsidiaries that do not qualify for PSLF despite the parent hospital’s nonprofit status

- Solution:Use the official PSLF Help Tool at studentaid.gov to verify exact employer eligibility before accepting any position

Mistake #6 — Failing to Consolidate NSL Before Pursuing PSLF

- NSL loans are not Direct Loans and cannot independently count toward PSLF’s 120-payment requirement

- Solution:Consolidate NSL into a Direct Consolidation Loan — but time the consolidation carefully, as it may reset your payment count

#9

State-by-State Nursing Loan Repayment Programs: Maximize Every Dollar Available

Beyond federal programs, individual states have developed robust nursing loan assistance programs that can dramatically accelerate debt elimination for nurses willing to serve in high-need communities for a defined period. Stacking state programs on top of your federal nursing student loan repayment strategy is one of the most underutilized yet immediately powerful approaches available to any working nurse in 2025. The key is applying early — most state programs operate on competitive annual cycles with strictly limited funding pools that fill within weeks of opening.

TABLE 4 — Sample State Nursing Loan Repayment Programs (2024–2025)

| State | Program Name | Max Award | Service Term | Setting Required |

|---|---|---|---|---|

| California | Song-Brown RN Education Program | $18,000+ | 1–2 years | Underserved communities |

| Texas | Texas Nursing Student Loan Repayment | $10,000/yr | 2 years | Rural or underserved areas |

| New York | NYS Nursing Faculty Loan Forgiveness | $10,000 | 2 years teaching | SUNY/CUNY nursing schools |

| Florida | FL Nursing Student Loan Forgiveness | $4,000/yr | 1 year per award | Eligible healthcare facilities |

| North Carolina | NC Nursing Scholars Program | $5,000/yr | 1 year per yr of award | Underserved areas in NC |

| Illinois | IL Nurse Educator Loan Repayment | Up to $5,000 | Ongoing teaching service | Accredited nursing schools |

9.1 How to Find Your State’s Nursing Loan Repayment Program

- Visit yourState Board of Nursing websiteand look for “loan repayment” or “workforce incentives” in the navigation

- Check your state’sOffice of Rural Health— many programs are channeled directly through rural health agencies

- Contact yourstate hospital association, which typically maintains updated lists of employer-sponsored programs

- Use theHRSA Data Warehouse(data.hrsa.gov) to identify Critical Shortage Facilities in your state where federal and state programs overlap

- Search theNASHP State Nursing Workforce Centerfor the most current state-by-state program directory

#10

Conclusion: Your Federal Nursing Student Loan Journey Starts with One Powerful Decision Today

Discover the federal nursing student loan in full — from eligibility and repayment to forgiveness pathways and expert strategies — and take your first decisive step toward lasting financial freedom today.

Managing a federal nursing student loan can feel overwhelming when you are simultaneously navigating the physical and emotional demands of an active nursing career — but the single most important truth in this entire guide is this: the tools, programs, and pathways to eliminate your nursing education debt already exist and are waiting for you to claim them. You have just equipped yourself with 7 powerful strategies, a clear comparison of forgiveness programs, up-to-date loan data tables, and the knowledge required to avoid the most expensive mistakes nurses make with their loans every year.

The nurses who successfully leave their debt behind are not the ones who waited for their financial situation to improve on its own — they are the ones who took decisive, well-informed action starting immediately. Begin with Strategy #1: submit or update your FAFSA today. Then identify your employer type, choose your repayment plan, and — if applicable — begin your formal journey toward PSLF or the NURSE Corps Loan Repayment Program. Every month you delay is another month of unnecessary interest accumulating on your principal balance.

Your nursing degree is one of the most valuable investments in the entire American healthcare system. Your federal nursing student loan should be a launchpad — not a lifelong financial anchor. Armed with the 7 comprehensive strategies in this guide, you now have everything you need to powerfully eliminate your nursing education debt and build the financially secure career you trained so hard to earn.

Quick-Reference Action Checklist

- Submit your FAFSA early and verify NSL eligibility with your financial aid office

- Log in to confirm your NSL servicer, balance, and next payment due date

- Confirm your employer’s PSLF eligibility using the official PSLF Help Tool

- Enroll in the SAVE IDR plan if your annual income is below $65,000

- Apply for the NURSE Corps Loan Repayment Program at the next open application window

- Research your state’snursing loan repaymentprogram and set a deadline reminder

- Schedule a free appointment with a certified student loan counselor at NFCC.org